BHEF’s Expanding Internships: Harnessing Employer Insights to Boost Opportunity and Enhance Learning revealed that in 2023, while 3.6 million students completed internships, another 4.6 million who sought similar experiences were unable to participate. The labor market value of internships is real, for students, the professionals they become, and their employers alike, with internships and other modes of work-integrated learning producing stronger outcomes in terms of post-graduation employment, career preparation, and career satisfaction. At the same time, AI is impacting the availability of jobs that offer the stepping-stone skills that teach young professionals meaningful foundations in their industry. Eighty-five percent of the rise in unemployment rate since mid-2023 is due to new market entrants who can’t find work, which could be a sign of companies already replacing entry-level jobs with AI.

Traditionally, young professionals have gained valuable skills through internships that help them land an entry-level job. However, a limited supply of internships relative to the number of students who need them, now further compounded by the disruption of AI, is making it harder for learners and young professionals to gain the work experience they need to be successful. Without early access to meaningful career development, we risk a long-term shortage of the next generation of mid-level professionals and executives. This opportunity gap is especially pronounced in industries where work-integrated learning plays a vital role in preparing talent for the workforce: in finance, professional services, and tech, internships are often a prerequisite to an entry-level job, yet there are not enough opportunities available to meet demand.

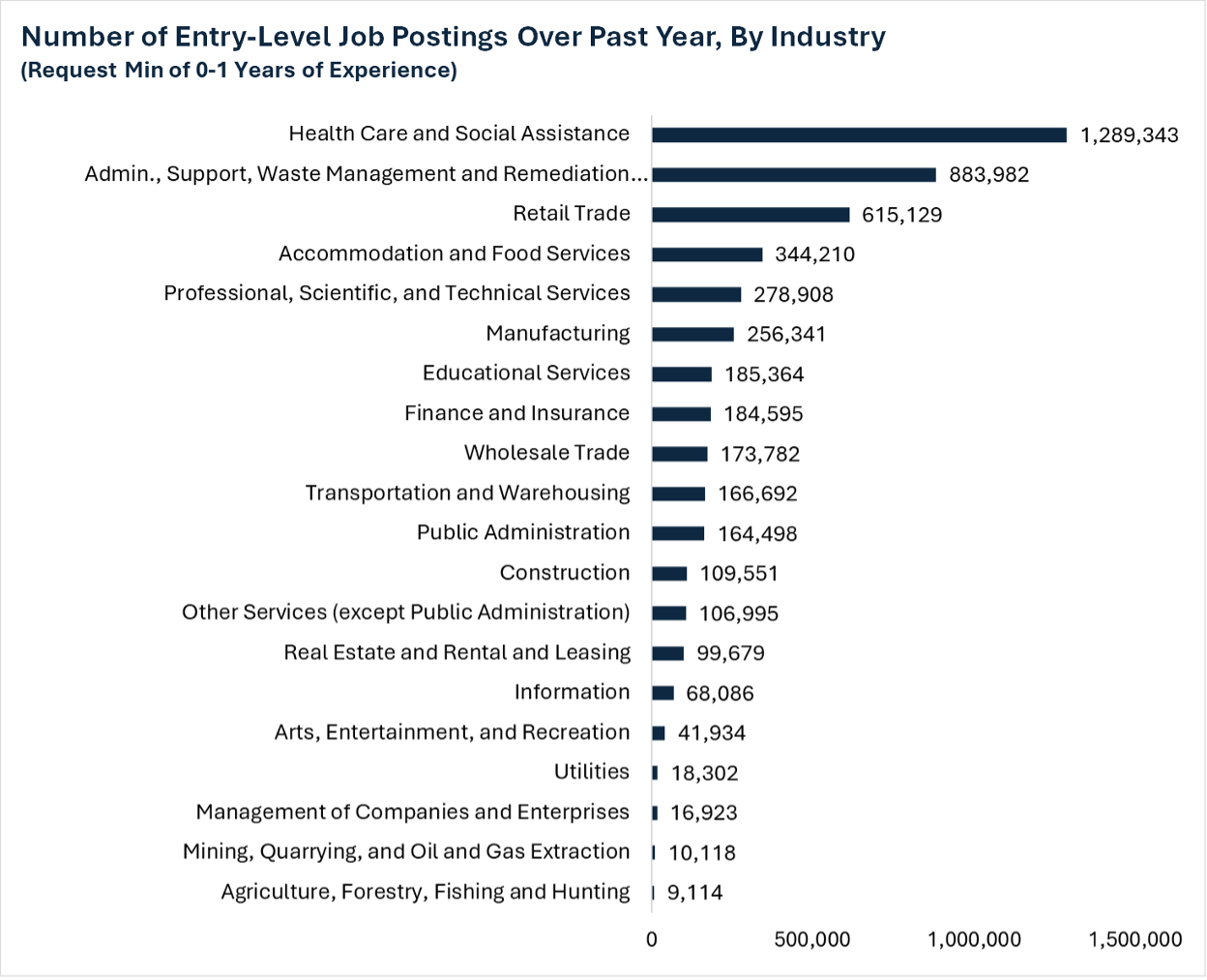

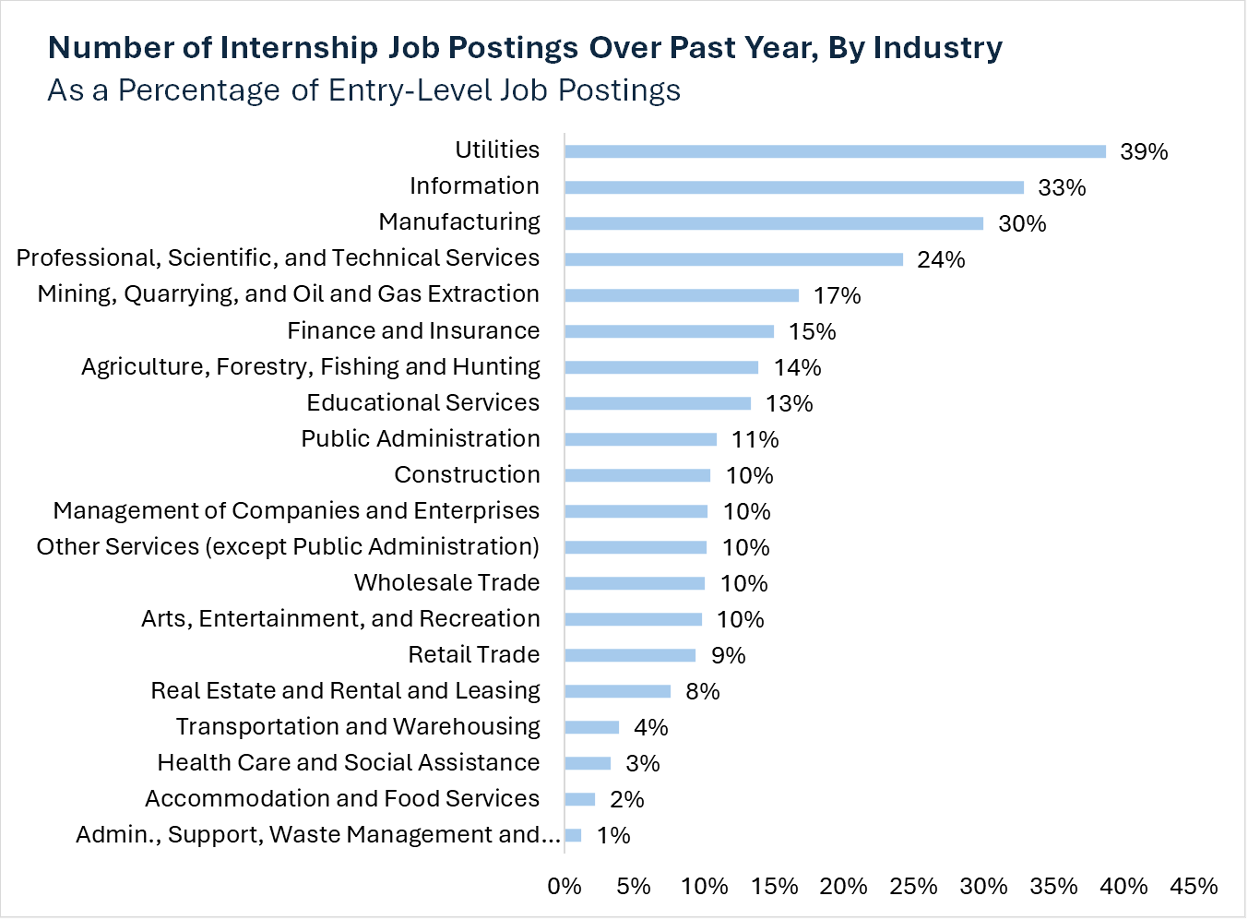

While internship job postings data is imperfect and does not always show the full range of work-integrated learning experiences, it still gives us a glimpse into the labor market. There is a key mismatch between industries’ demand for entry-level talent and their supply of internship opportunities, which is an early signal of how well each sector is investing in its own early talent pipeline. Internship supply varies greatly by industry:

Above Average Investment in Internships

Industries like utilities, information, and manufacturing offer the greatest share of internships compared to other industries (30–40% internship job postings as a percentage of entry-level postings). These industries are investing in preparing early talent that they subsequently have a high demand for. But, even in these industries, internships only cover about one-third to two-fifths of entry-level demand. That gap leaves a large share of new hires potentially without formal pre-employment experience, raising questions about how the rest gain critical skills and experience to land that first job.

Internships not only serve as a hiring pipeline or way to augment work; other industries can learn from how, for example, manufacturing has found success leveraging work-integrated learning as a larger business strategy. Our team recently had conversations with manufacturing companies of various sizes. They had overlapping frustrations around misperceptions of jobs in their industry, but they also shared sentiments about the value of internships to the field as a whole. Quality internships promote the industry itself; even if one company’s interns go elsewhere, the job training strengthens the whole sector and some even come back to work for the company later in their career with more experience.

Major Gaps in Pipeline

Industries such as professional services, finance, and healthcare hire large volumes of entry-level workers but offer relatively few internships. While healthcare professionals may gain work-integrated learning experience through clinicals or in-program training (not always captured in job posting data), fields like finance and professional services show a clear need for more intentional internship pathways. Job postings for professional services declined by more than 40% since 2021, leading to an increase in unemployment in the industry. There are fewer job openings in these industries, leaving professionals unable to find work, which could be impacting investments, or lack thereof, in developing early career talent.

Work-integrated learning is valuable, even in industries where it is not the expectation. Internships offer learners critical career exploration, transferable skills, and workplace skills that can’t be learned in the classroom. For employers, they are a chance to promote and market their industry, build talent pipelines, access motivated talent at a lower cost, and reduce their length of training for an entry-level hire.

Regardless of the industry, internships are not offered at the necessary scale to enable all learners to access these experiences. This calls for employers to intentionally build more work-integrated learning opportunities, including project-based learning, career exploration, and more, to give young professionals the experience they need to succeed and compete with AI. While internships yield positive benefits to recruiting and development for many employers, they also have the reputation of being resource intensive and a challenge for the employer to facilitate.

However, they do not have to be. At the Business-Higher Education Forum, we are focused on building tools to help your organization, lowering the lift and making internships and other work-integrated learning opportunities accessible to your company and to more learners.

In order to train the next generation of workers and to ensure they are equipped with in-demand workplace durable and technical skills, business and higher education need to work together to create more work-integrated learning opportunities. There are a variety of ways that businesses, education, and intermediary organizations can aggregate supply and demand, decrease friction, and increase the availability of work-integrated learning experiences. These models can focus on scaling resources and implementing an experience best for the company’s structure, hiring demands, and time and resource assets and constraints. Consortium, state, and sector work-integrated learning approaches offer models that can be tested, expanded on, and replicated across the country to meet the needs of a broad span of industries in order to develop the next generation of workers.

- State and Regional Efforts: Increasingly states or state systems are exploring statewide, coordinated approaches designed to embed meaningful workplace experiences from employers across sectors into academic programs at scale. State models often have support from state government and public entities to focus resources across the state and to ensure that they are also reaching underserved communities whether those be by industry, region, or demographic population. In New York, through its public colleges and university systems, SUNY and CUNY, the state has increased their investments in providing work-integrated learning opportunities for students across the state, including operating six grant programs with a total budget of $35 million with the goal of reaching all learners. Similar efforts are underway in Virginia, Pennsylvania, and other states.

- Sector-based Models: These models are designed and delivered in alignment with specific needs of a particular industry sector such as healthcare, manufacturing, or tech. They are also often operationalized in the context of a sector and region. Rather than being generalized across many industries, the model focuses on preparing learners with the exact skills, knowledge, and experiences that a sector requires – and where employers and educators are co-investing in creating tomorrow’s talent. For example, the Kentucky Federation for Advanced Manufacturing Education is a group of regional manufacturers who partnered with community colleges to develop an apprenticeship program that blends classroom learning and paid on-the-job training for aspiring technicians. Over five semesters, participants attend college while working for a sponsoring manufacturer, earning an associate degree and an Advanced Manufacturing Technician certification and gaining two years of experience. The state has various chapters, each led by local manufacturers who collaborate to define the skills and competencies needed for their region’s workforce, and they jointly recruit, sponsor, and mentor students.

- Institution Consortia Model: In addition to models that respond to the needs of particular sectors and industries, there are also a growing number of consortium models bringing together institutions with limited resources to pool opportunities and expertise. This has the potential to increase scale by offering a singular hub for learners to find training, mentorship and placements and to expand industry outreach beyond what one institution can achieve alone. The Council for Independent Colleges and Complete College America have created versions of this consortia model. For example, Complete College America and experiential learning platform Riipen teamed up to build the CCA AI Readiness Consortium to embed AI competencies into a selection of five open-access institutions across the country through project-based learning provided by industry partners.

With the pace of AI disruption, higher education and business will need to work closer than ever to ensure current professionals and incoming professionals are equipped with the rapidly changing skills needed to succeed in today’s workforce. These models represent just some of the strategies we see the opportunity to expand and scale to ensure we are creating work-integrated learning infrastructure that can scale to meet the needs of our future workforce.