The latest concerning AI development: AI is shutting entry-level workers out of the labor market. AI is taking over work in areas where early career professionals once developed skills, learned through doing, and advanced into higher-level roles. A recent survey from Deloitte found that early career professionals are generally more optimistic about AI’s impact on their work, but they are also the most concerned about AI reducing development opportunities, such as on-the-job training. In response, educators and businesses must work together to build tomorrow’s workforce.

At BHEF’s 2025 Spring Convening, Matt Beane, author of The Skill Code, warned that organizations are prioritizing short-term productivity through AI at the expense of novice skill development. More experienced professionals now turn to AI to augment basic tasks rather than asking a younger professional for assistance. At one extreme, the CEO of Shopify is making the use of AI a business requirement: an employee's use of AI will be considered during performance reviews, and new positions will be created only when AI can't fill the role. This trade-off may boost efficiency now, but it risks leaving us without experienced talent to fill higher-level roles down the road.

Labor market data already shows warning signs. Many traditionally entry-level roles, such as bank tellers, data entry clerks, cashiers, administrative assistants, accounting bookkeeping and payroll, transportation attendants, sales, claims adjusters and examiners, and legal secretaries, are projected to decline rapidly. This is due to AI reshaping required skills profiles of occupations by substituting skills like reading, writing, mathematics, marketing and media, systems thinking, programming, financial management, tech literacy, and design and user experience for skills in AI and big data.

Some examples of entry-level job shifts that have historically been paths into varied professional careers:

- Data entry clerks: projected to decline by 25% by 2033

- Customer service representatives: projected to decline by 5% by 2033

- Administrative assistants: hiring is 5.9% lower than last year

- Tax examiners: face a skills disruption index of 76.9 from 2021 to 2024

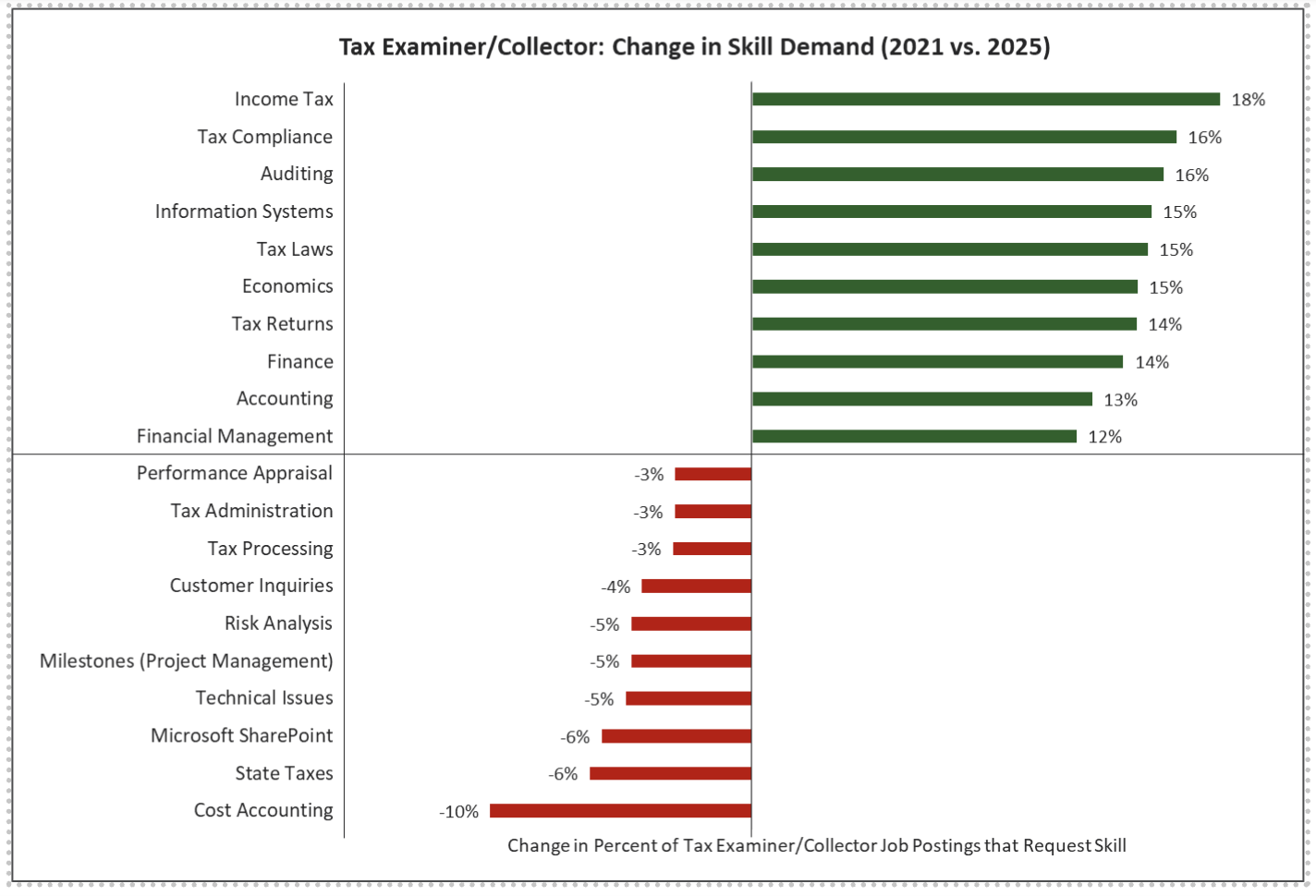

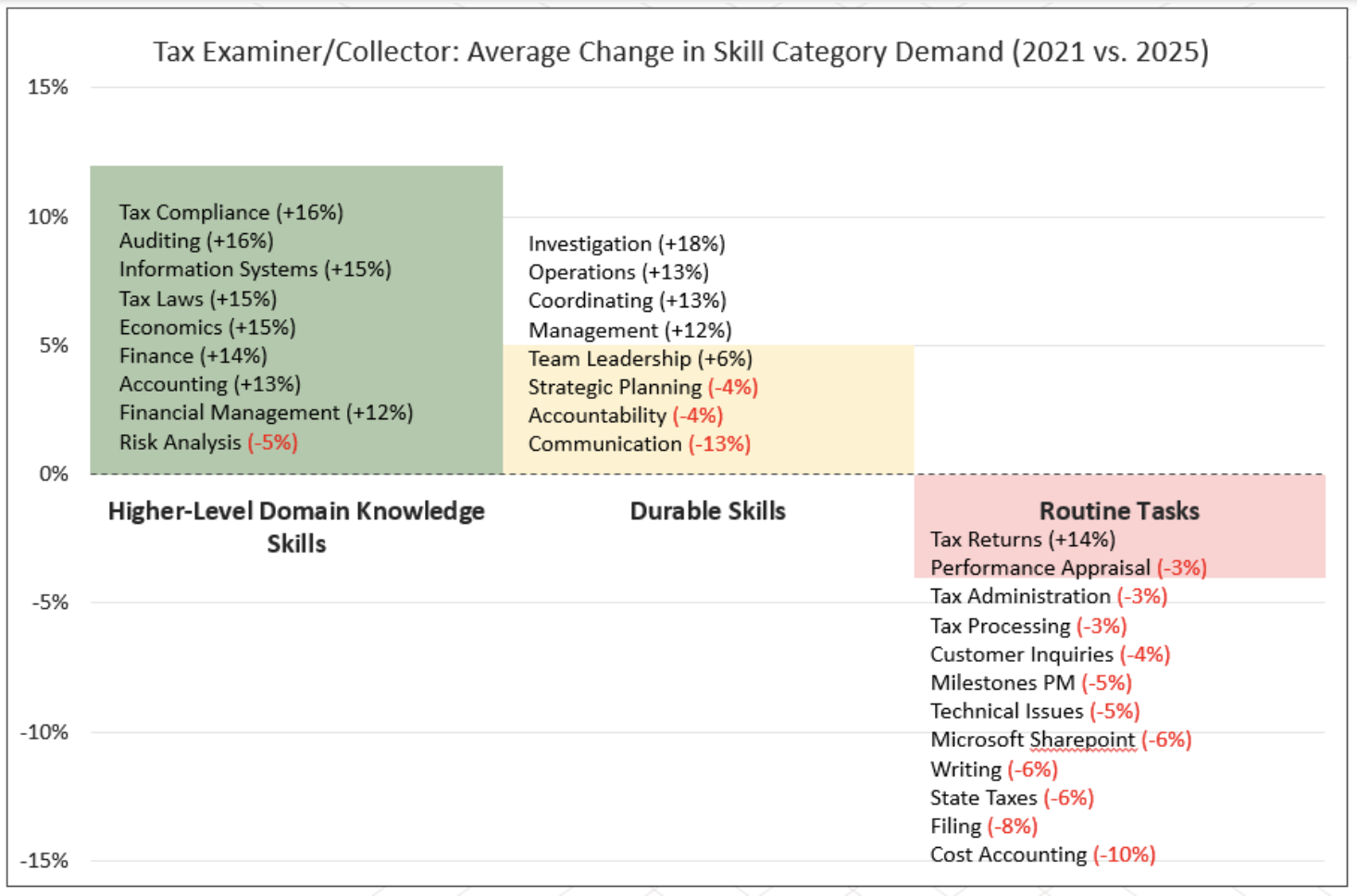

The tax examiner field illustrates how skills profiles are evolving to reflect a new reality, one in which AI handles the routine tasks and the employee steps in to interpret and judge results and develop a broader strategy. In a recent statement, EY shared how AI will transform tax compliance, including bringing efficiencies to unstructured data, automating routine processes, and empowering employees to take on a more strategic role. Demand for information systems skills is up 15%, indicating that tax examiners are now expected to interface with new technology tools. Meanwhile, routine tasks are declining––tax administration (-3%), customer inquiries (-4%), and cost accounting (-10%)––suggesting these are increasingly handled by AI systems. Increase in skills related to tax law (+15%), economics (+15%), and finance (+14%) are on the rise, along with a rise in job postings requesting a Certified Public Accountant credential (up from 13% in 2021-2022 to 26% in 2024–2025). This clear trend toward durable skills like investigation (+18%) and interpretation of results requires higher levels of financial and regulatory expertise.

For job seekers, the bar for entry-level positions is rising; young professionals may need additional certifications, internships, or specialized training simply to get a foot in the door.

For employers, the challenge is to ensure that pathways for skill development do not disappear entirely, and to balance productivity with professional development. Without intentional investment in career development programs, apprenticeships, and education in high demand fields and skills, a generation of workers will be locked out of the labor market.

Learn how the Business-Higher Education Forum is developing solutions to build a resilient, AI-ready workforce through its AI and the Future of Talent Collaborative.